Printable Self Employed Tax Deductions Worksheet – Locate the right Printable Self Employed Tax Deductions Worksheet for your next project—it’s free, effortless to download, and formatted to print in moments. No login, no complexity, simply what you need.

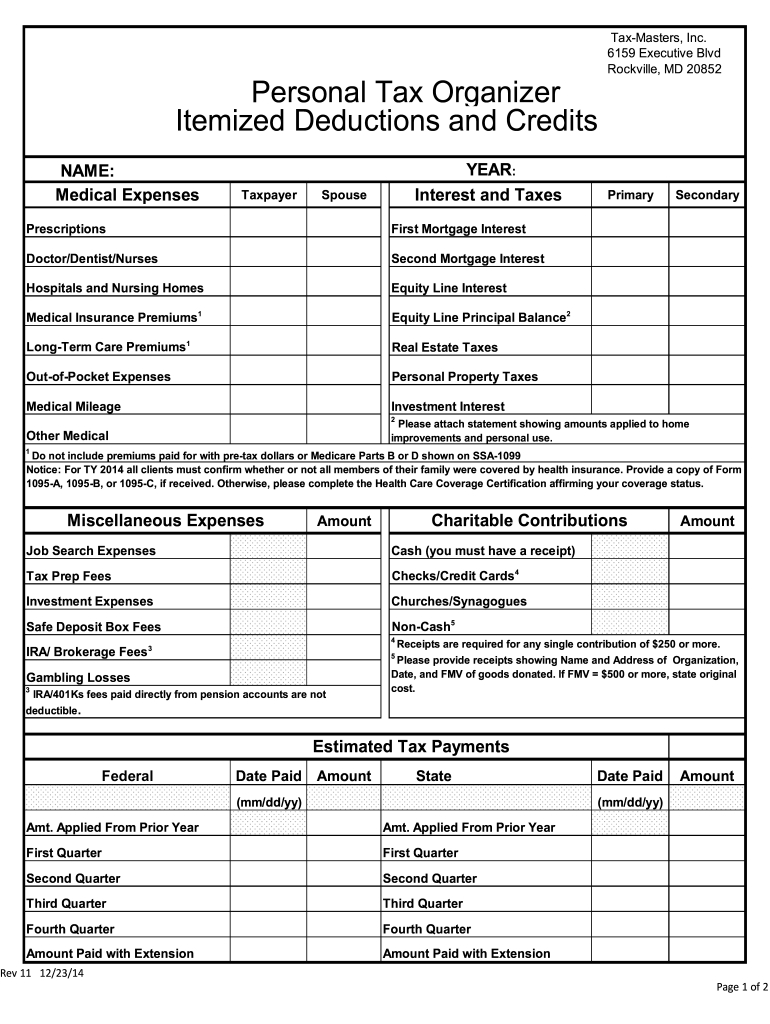

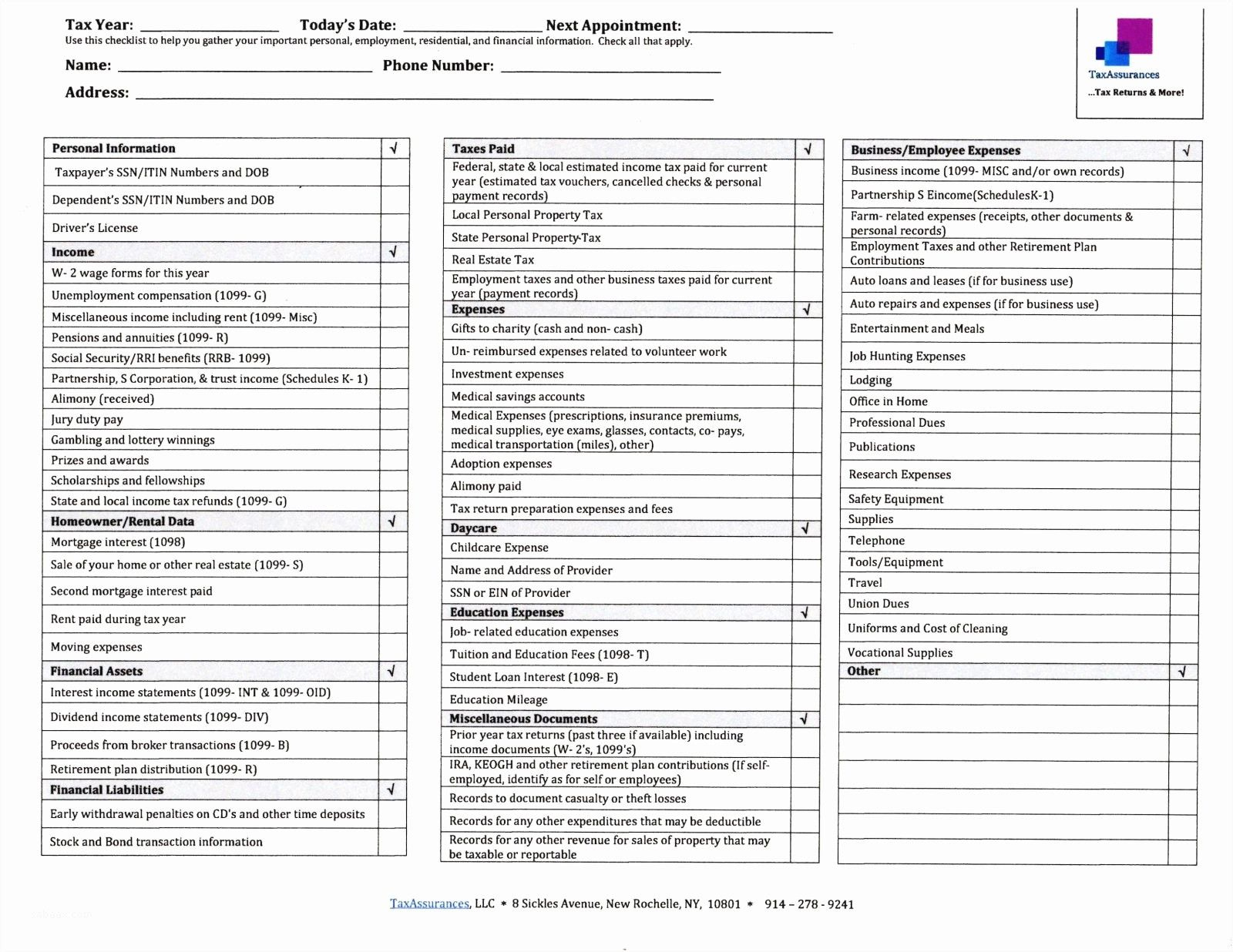

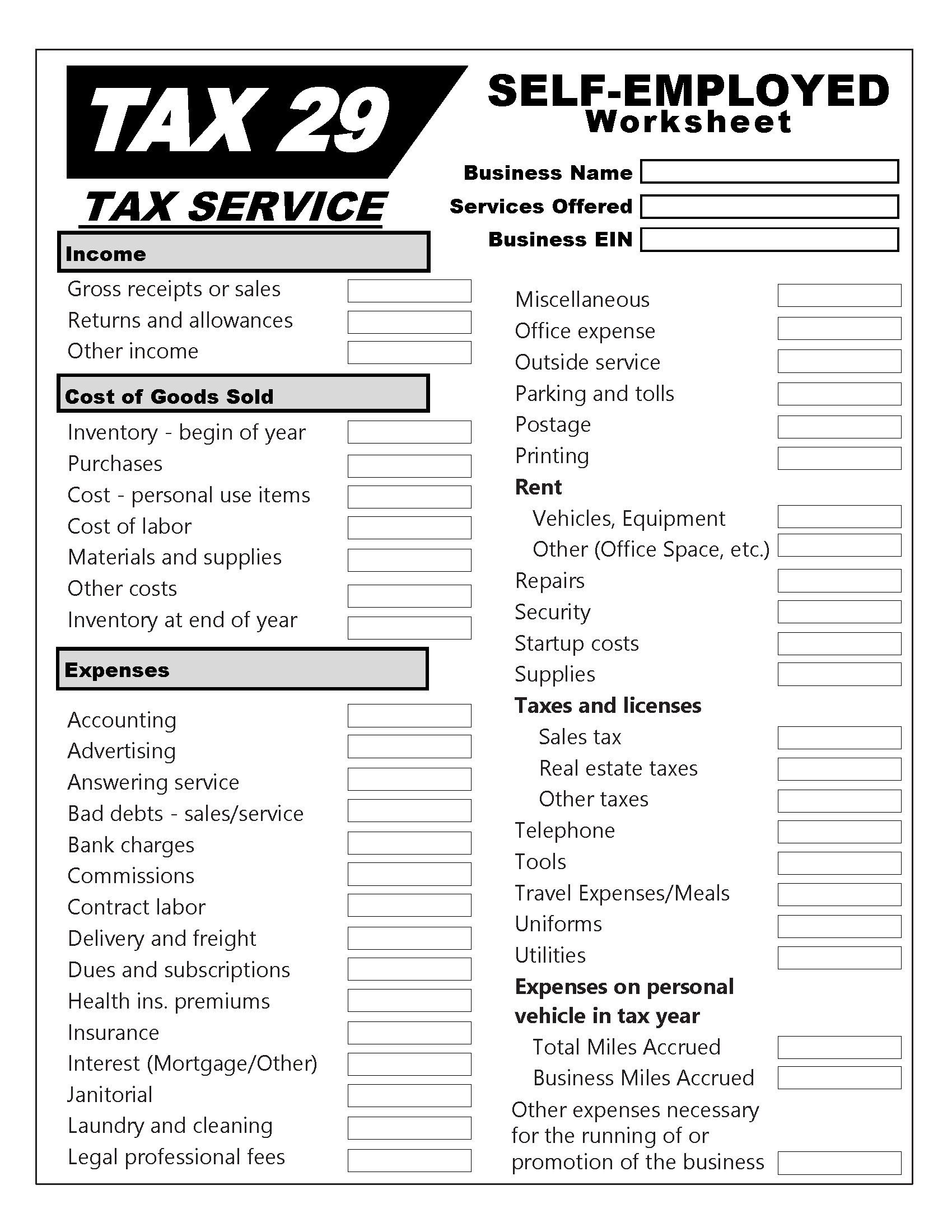

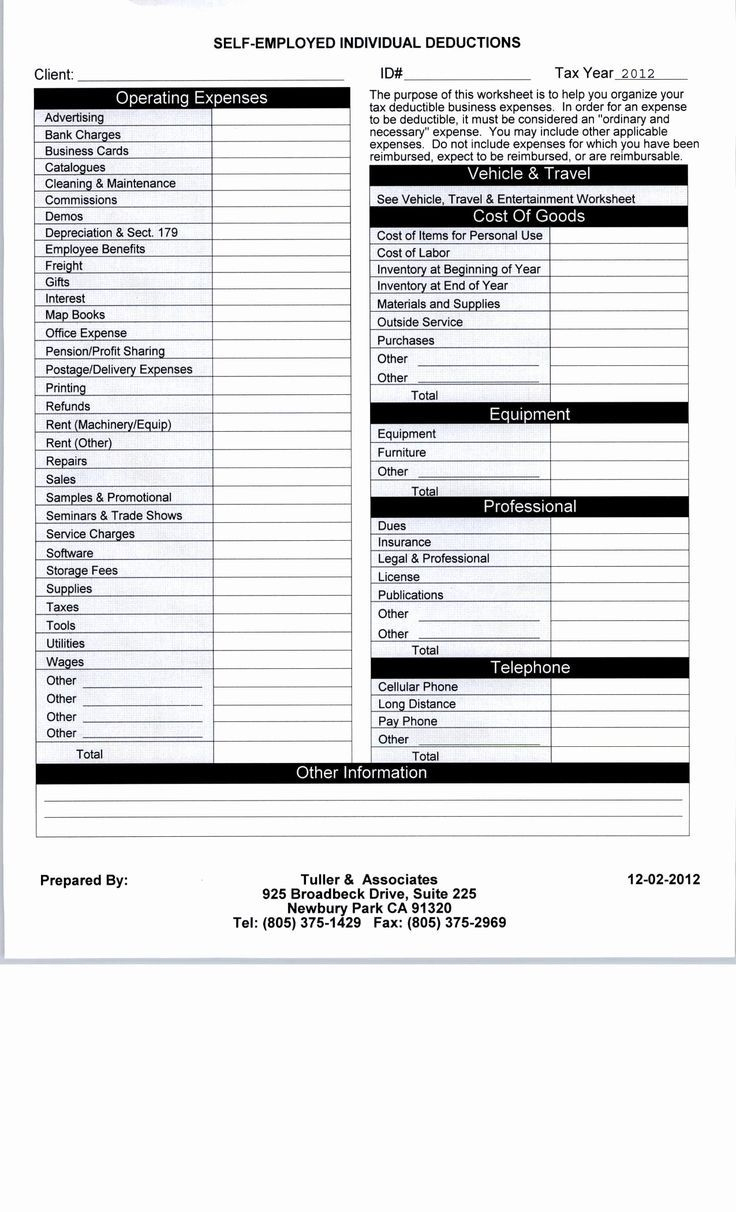

Are you a self-employed individual looking to maximize your tax deductions and save money? Look no further! With a printable self-employed tax deductions worksheet, you can easily keep track of all your business expenses and ensure you are taking advantage of every deduction available to you. This handy tool will not only help you organize your finances but also potentially lower your taxable income, leading to significant savings come tax season. Say goodbye to the stress of tax preparation and hello to a more efficient and cost-effective approach to managing your business finances.

Maximize Your Deductions

One of the key benefits of using a printable self-employed tax deductions worksheet is the ability to categorize your expenses and identify areas where you can maximize your deductions. By keeping detailed records of your business-related expenses, such as office supplies, travel costs, and advertising expenses, you can ensure that you are claiming every eligible deduction when you file your taxes. This proactive approach can result in significant savings and help you keep more of your hard-earned money in your pocket.

Furthermore, a tax deductions worksheet can also serve as a valuable tool for planning and budgeting throughout the year. By tracking your expenses on a regular basis and noting which items are tax-deductible, you can make more informed financial decisions for your business. This level of organization and foresight can not only lead to tax savings but also help you better manage your cash flow and overall financial health. So why wait? Start using a printable self-employed tax deductions worksheet today and take control of your finances.

Simplify Your Tax Preparation

Another advantage of utilizing a self-employed tax deductions worksheet is the ease and convenience it offers when preparing your taxes. With all your expenses neatly documented and categorized, you can streamline the tax filing process and avoid the last-minute scramble to gather receipts and documentation. This can save you time, stress, and potentially costly mistakes that could result in penalties or audits.

Moreover, a printable worksheet can also serve as a valuable reference tool in the event of an IRS audit or inquiry. Having detailed records of your expenses readily available can help substantiate your deductions and provide peace of mind knowing that you are well-prepared for any potential scrutiny. So don’t let tax season overwhelm you – arm yourself with a self-employed tax deductions worksheet and take the guesswork out of filing your taxes. With this simple yet effective tool, you can stay organized, maximize your deductions, and keep more money in your pocket.

Printable Self Employed Tax Deductions Worksheet

Related Printables..

Disclaimer: We use images for commentary and illustration on this site. No copyright infringement is intended. If you find an image that belongs to you and want it credited or removed, provide proof of ownership, and we will take appropriate action.